The role of the finance department has evolved significantly in recent years. Until recently, finance teams were primarily focused on crunching numbers, bookkeeping, consolidating inputs, and monitoring the spending of other areas. There was little distinction between finance and accounting, and most of their time was spent on recording transactions, filling regulatory reports, and preparing financial statements. Their core function was centered around manual work with a backwards-looking perspective.

Today, that has changed. Finance now plays a central role in shaping the financial strategy and guiding the overall direction of the business. It is actively involved in decision-making across all areas of the organization and has become a strategic finance partner with a forward-looking mindset.

This evolution has led to structural changes within finance organizations, most notably the rise of the Financial Planning and Analysis (FP&A) function. This shift can be largely attributed to major technological advancements, particularly with the widespread adoption of computing systems and the digitization of data, which have significantly boosted the productivity of finance and accounting teams. At the same time, as corporations look to move faster and stay ahead of the competition, they started demanding for better, real-time, and more accurate data insights.

Having spent several years as FP&A professional for large multinational companies across Europe, Asia and the Americas, I’ve witnessed first hand the transformation of the finance function and the growing relevance it has gained within organizations.

In this post, we’ll take a deeper look at the role of FP&A teams, their main responsibilities, key skill requirements and the critical areas where they can drive meaningful impact.

What is FP&A?

The Financial Planning & Analysis area is part of the company’s finance organization, responsible for overseeing the financial and operational performance. It supports critical and strategic decision-making through forecasting, budgeting, reporting and analysis, ensuring the performance aligns with the business objectives. FP&A deliverables are intended for management internal purposes effectively using managerial accounting principles.

While FP&A’s primary focus is on maximizing profitability—making it heavily involved in P&L management—its scope extends well beyond revenues and expenses. FP&A also plays a relevant role in other financial aspects such as capital expenditures, working capital, legal structure, and taxes, contributing to decisions that impact the balance sheet and cash flow statements.

Financial Controller versus FP&A

In the early days of the finance transformation, the responsibilities of budgeting, forecasting, and reporting were often consolidated under the Controllership function. Finance and accounting operated as a single unit, performing both financial and managerial accounting. As FP&A gained prominence, it became clear a new structure was needed—one that defined a more independent scope and set of responsibilities while maintaining strong collaboration between functions.

A typical Financial Controller is responsible for ensuring accurate bookkeeping and recording transactions in accordance with accounting standards and legal requirements. They oversee the management of the companies’ legal entities, regulatory fillings, and the preparation of financial statements for external stakeholders. In some companies or industries, the Financial Controller may also take on certain FP&A tasks, such as budgeting or business partnering.

That said, it’s important to understand that Controllership and FP&A are two distinct functions within the finance organization. While they are interconnected and collaborate closely, each have a different focus. Together, they help ensure financial integrity and discipline, and support the CFO in driving sound financial management and executing the company’s financial strategy.

The Role of FP&A. What Makes a Great Finance Partner

Financial planning has become essential for organizations of all sizes. Successful, modern companies rely on diligent and comprehensive financial planning to drive growth, be profitable, and ensure adequate liquidity. Having financial agility allows them to respond quickly to economic trends and seize market opportunities.

The main role of FP&A is to translate strategic plans into actionable measurable goals across the entire organization, oversee its execution, and provide senior management with insights on progress and effectiveness.

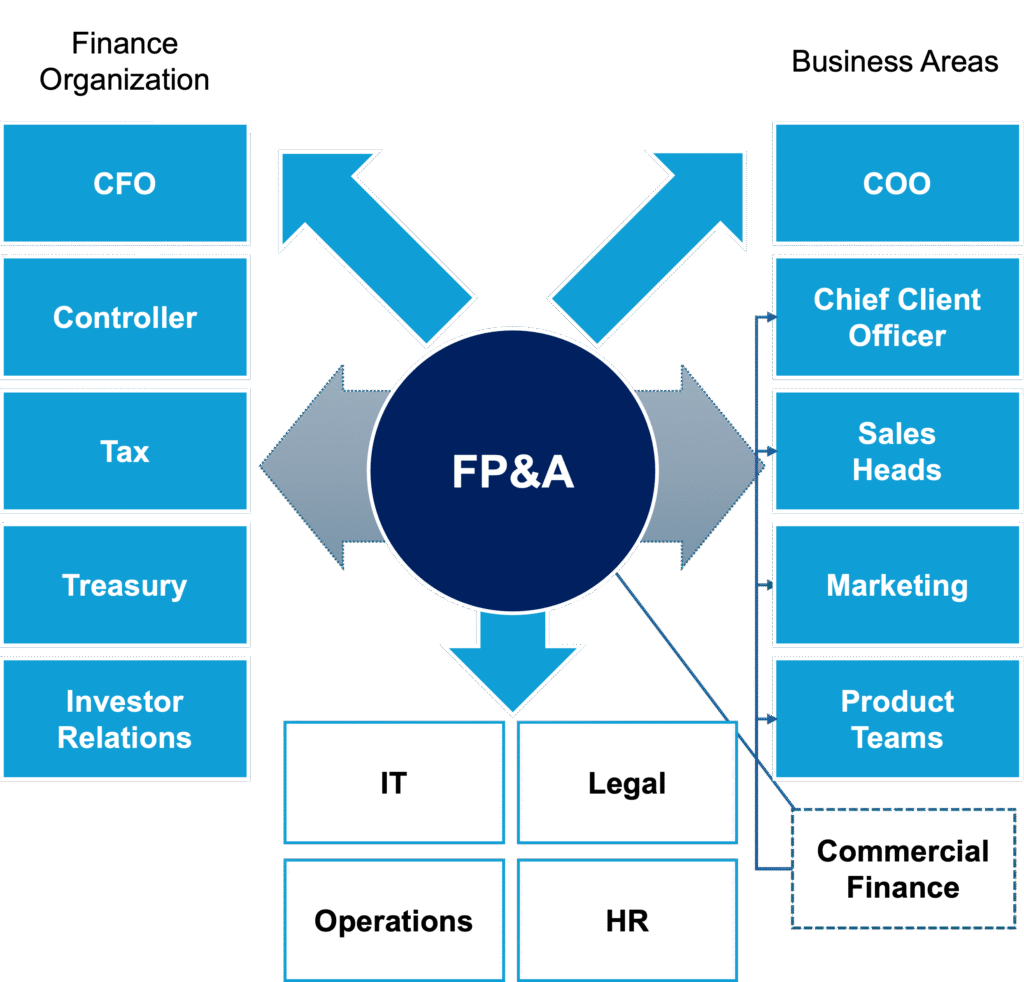

As FP&A carries the responsibility of forecasting, budgeting and analyzing the company’s financials and operating metrics, it must collaborate and interact closely with multiple departments. FP&A acts as a key liaison between corporate finance and business teams—constantly communicating, gathering information, generating reports and insights, and acting as a bridge to help execute the company’s financial strategy.

In some organizations—particularly larger ones—the FP&A function is embedded within business units through dedicated Commercial or Business Finance teams. These teams mirror many of the core responsibilities of FP&A but operate with a narrower focus, often covering a specific business line, product, region, or functional area such as Marketing, R&D, or IT.

As a modern finance function, FP&A demands a broad skill set that goes beyond accounting and financial analysis. The most successful and impactful FP&A professionals have a multidisciplinary knowledge. They possess a strong understanding of business, economic and market trends, as well as deep knowledge of the company’s operating model, revenue drivers, the industry landscape, and competitor environment.

A successful FP&A leader is commercially savvy and proficient with technological tools. They demonstrate to have strong soft skills, communicate clearly, and can effectively articulate complex information. They have the ability to analyze quantitative and qualitative information to evaluate the business performance and support senior management in strategic decision-making.

Another highly important but often under-appreciated skill is the ability to influence and challenge senior business leaders effectively. I’ve learned throughout my career that it’s not enough to simply present the facts—you also need to demonstrate presence, have an open mind, and engage with others in a confident, assertive manner. Ray Dalio in his book “Principles Life and Work”, introduces the concept of thoughtful disagreement1—the idea that the goal isn’t to prove or convince the other party that your point is right, but rather to uncover what is true and determine the best course of action. Appreciating and developing the art of thoughtful disagreement is an essential skill to become a valuable Finance Business Partner.

Outstanding FP&A professionals carry most of these attributes. They are comfortable stepping beyond their scope and consistently look to add value to their stakeholders.

Unlocking Value: Three Key Areas Where FP&A Impacts the Business as a Strategic Partner

FP&A teams often dedicate a significantly portion of their time to forecasting, budgeting, and reporting—activities that form the foundation of financial planning. However, these core tasks are only truly impactful when delivered with timely, insightful analysis. The following are three critical areas where FP&A can drive tangible impact in business outcomes by leveraging key financial levers.

Maximize Sales Performance and Margin Expansion

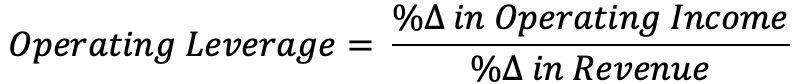

Operating leverage measures the company’s cost structure between fixed and variable costs and how it affects to operating income. A company with higher proportion of fixed costs relative to variable costs will see a greater impact on its profit margins as revenue grows. In other words, businesses with high operating leverage experience greater profits when revenue increases, but they are more sensitive when revenue declines. In contrast, companies with low operating leverage benefit less from revenue growth but tend to be more resilient during economic downturns due to lower fixed costs.

FP&A can play a critical role in boosting sales performance and driving margin expansion by having a thorough understanding of the company’s cost structure, pricing and product margins. For instance, calibrating sales commissions between fixed and variable components, setting pricing strategies, or evaluating decisions such as opening a new plant or office. Timely financial modeling of these levers is crucial to support operational executions and strategic planning.

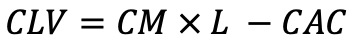

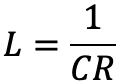

Another metric that has gained relevance in recent years is Customer Lifetime Value (CLTV or CLV). According to a research paper by Harvard Business School2, CLV is a metric that enables managers to understand and quantify the long-term value of their customer base. This metric is dependent on three factors; the cost to acquire a customer, the annual profit generated by a customer and the number of years of the customer relationship.

Initially deemed as a tool for marketers to guide marketing expenditures, FP&A professionals can also leverage CLV analysis to support and guide decision-making across departments such as sales, product and customer service. Examples of strategic use cases include identifying the most profitable customer segments, optimizing the allocation of pre-sales and post-sales resources, and support incremental spending to acquire new customers, or try to up-sell or cross-sell additional products to existing customers.

Drive Efficiency Through Working Capital Management

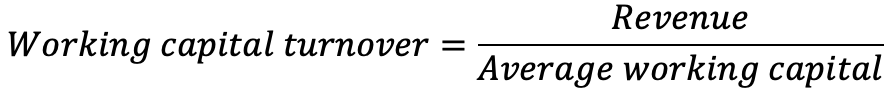

While working capital is a measure of liquidity, Working Capital Turnover3 reflects how efficiently a company uses its working capital to generate revenue. FP&A professionals can play a key role in driving operational efficiency by collaborating with cross-functional teams to streamline internal processes. This includes optimizing sales operations, improving the quote-to-cash cycle, automating invoicing, ensuring seamless integration between ERP and CRM systems, strengthening cash management practices, and minimizing overdue payments—among other high-impact initiatives.

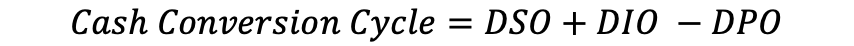

Analyzing the Cash Conversion Cycle provides valuable insights into the company’s operational efficiency and liquidity. The Cash Conversion Cycle measures the time it takes a company to convert its inventory into cash after a sale, collect its outstanding receivables and pay suppliers. Closely monitoring the Days of Inventory Outstanding (DIO) and Days of Sales Outstanding (DSO) is highly important for effective working capital management. Business models with shorter cash conversion have greater liquidity. In contrast, companies with longer cash conversion cycles tend to have lower liquidity, implying they must finance their operations with additional capital.

Optimizing Allocation of Investments and Headcount

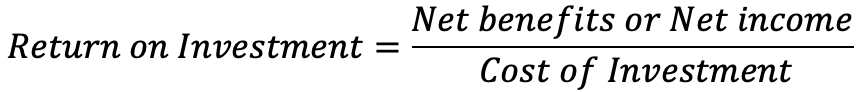

The Return on Investment (ROI) is a profitability ratio that indicates the rate of return of a specific investment. It measures the net benefits or net income and the corresponding costs of a particular investment. ROI is widely used as part of companies’ internal processes to evaluate and compare investment opportunities. FP&A professionals take a highly visible and strategic role by leveraging ROI to guide decision of capital allocation.

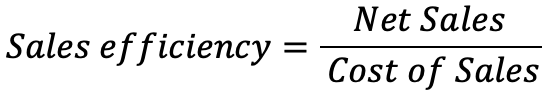

Sales Efficiency is similar to ROI but specifically focused on evaluating the performance of sales individuals and teams. It is a profitability ratio that measures the amount of sales and the corresponding cost over a specific period of time.

Commercial Finance teams closely monitor sales efficiency as part of sales performance management and strategic planning. This metric helps guiding business decisions such as optimizing sales personnel allocation, supporting hiring and redundancy decisions, guiding appropriate sales quota levels, and calibrating sales compensation structures.

Conclusion

Corporations across industries and geographies have recognized the importance of having robust and accurate financial planning processes. The FP&A function is no longer a static or rigid finance team, as it is sometimes perceived by outsiders. It is a dynamic, agile unit that acts as a Strategic Finance Business Partner embedded at the core of the company’s business and operations.

Organizations that overlook or undervalue the role of Finance Business Partners risk falling behind, move slowly, and ultimately underperforming financially. In today’s digital era—where data is a critical asset—FP&A plays a key role unlocking the potential of data-driven strategies to maximize financial performance and drive optimal decision-making.

References

- Dalio, Ray. “Appreciate the art of thoughtful disagreement”, Principles by Ray Dalio, September 2017. ↩︎

- Steenburgh, Thomas, and Jill Avery. “Marketing Analysis Toolkit: Customer Lifetime Value Analysis (2024).” Harvard Business School Background Note 525-017, July 2010. (Revised January 2017.) ↩︎

- CFA Institute, CFA Program Curriculum, Financial Reporting and Analysis, 2018 Level I Volume 3. ↩︎